Contents:

These bars form the basis of the next chart type called candlestick charts which is the most popular type of Forex charting. If the trade is successful, leverage will maximise your profits by a factor of 10. However, keep in mind that leverage also multiplies your losses to the same degree. By the end of it, you’ll know all the most essential terms used in Forex trading so you won’t be confused at any point while you learn to trade.

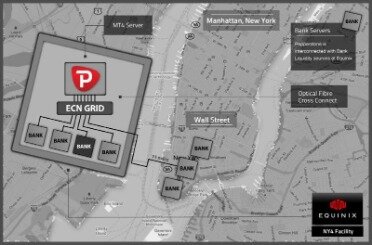

E-mail The MT4/MT5 ID and email address provided do not correspond to an XM real trading account. It is an order to buy or sell currency instantly at the current price. You expect the EUR to strengthen as compared to the USD, so you will buy EUR and profit from its increase in value. When you enter and exit your position, you must always watch the spread in the bid/ask quote.

Close a Position

The difference to the bar charts is in the ‘body’ which covers the opening and closing prices, while the candle ‘wicks’ show the high and low. Compared to crosses and majors, exotics are traditionally riskier to trade because they are more volatile and less liquid. This is because these countries’ economies can be more susceptible to intervention and sudden shifts in political and financial developments.

5 Basic Forex Market Concepts – Investopedia

5 Basic Forex Market Concepts.

Posted: Sat, 25 Mar 2017 12:45:57 GMT [source]

Learn the main differences between forex and stocks to understand the best market to trade based on your trading style and strategy. Browse the articles below for an introduction to FX trading, including practical advice on how to become a forex trader and first-hand accounts from market practitioners. When it comes to trading currencies, the key to remember is that yield drives return.Every currency comes with an interest rate set by that country’s central bank. A currency trader can accrue interest on the difference between the interest rate of the currency they sold and the currency they bought. The decentralized nature of forex markets means that it is less accountable to regulation than other financial markets. The extent and nature of regulation in forex markets depend on the jurisdiction of trading.

Position

But like with everything else, you still have to familiarize yourself with the basics behind currency movements in order for you to be successful in the field. Read our guide to forex market size, trading volume and liquidity and how to take advantage. Learn how to become a consistent forex trader with advice from DailyFX analysts. A currency carry trade is a strategy that involves using a high-yielding currency to fund a transaction with a low-yielding currency.

Rapid Results Method Reviews (Russ Horn) Is It Legit And Worth Buying? – Outlook India

Rapid Results Method Reviews (Russ Horn) Is It Legit And Worth Buying?.

Posted: Fri, 03 Feb 2023 08:00:00 GMT [source]

Put your trading plan to the test in real market conditions with a risk-free FOREX.com practice account. You’ll get a chance to see what it’s like to trade currency pairs while taking your trading plan for a test drive without risking any of your own capital. Thanks to the widespread availability of electronic trading networks, forex trading is now more accessible than ever. The largest financial market in the world offers vast opportunities for investors who take the time to get to understand it and learn how to mitigate the risk of trading.

If you are interested in practicing your trading in a risk free manner, but with real conditions and a live market environment, why not register for a free demo account here at Admirals? You can trade with virtual funds and practice your strategies without putting any of your funds at risk. However, if someone day trades, they may also make long term investments as well (a long-term portfolio). Therefore, leverage should be used with caution, regardless of whether we are talking bout trading for beginners or experts. If your account balance falls below zero euros, you can request the negative balance policy offered by your broker. Using this protection will mean that your balance cannot move below zero euros, so you will not be indebted to the broker.

An example of a currency pair is the euro against the U.S. dollar or most commonly shown as EUR/USD, also known to be one of the widely traded currency pairs. In the United States, the National Futures Association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized.

Currency Pair

Many traders find candlestick charts the most visually appealing when viewing live Forex charts. They are also very popular as they provide a variety of price action patterns used by traders all over the world. They are similar to OHLC bars in the fact they also give the open, high, low and close values of a specific time period. However, candlestick charts have a box between the open and close price values. In either case, the OHLC bar charts help traders identify who is in control of the market – buyers or sellers.

To create a basic program in forex, you need to learn a programming language. The most popular programming languages used in forex trading are MQL4 and MQL5. These programming languages are specific to the MetaTrader platform and are easy to learn.

In fact, the forex market is the quiet giant of finance, dwarfing all other capital markets in its world. A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. The first step to forex trading is to educate yourself about the market’s operations and terminology. Next, you need to develop a trading strategy based on your finances and risk tolerance.

Two well-known stock exchanges are the NASDAQ and the New York Stock Exchange . A broker is a person or company that helps facilitate your buying and selling of an instrument through their platform . Currency correlations are important for traders to consider as no pair trades independently on others. Learn the importance of margin in forex trading and how to apply it. Find out how short selling is used in a down trending market or to hedge currency exposure. Currencies being traded are listed in pairs, such as USD/CAD, EUR/USD, or USD/JPY.

Pip

You can also go long or short depending on whether you think a forex pair’s value will rise or fall. You’ll find everything you need to know about forex trading, what it is, how it works and how to start trading. After testing your program, you may need to optimize it to improve its performance. You can do this by adjusting the parameters of your trading strategy to find the optimal settings.

However, it is vital to remember that trading is risky, and you should never invest more capital than you can afford to lose. Foreign exchange trading uses the difference in currency pairs to generate returns. Traders scalp Forex when they make many small trades on currency pairs following small price movements throughout a trading day. Because forex trading requires leverage and traders use margin, there are additional risks to forex trading than other types of assets. Currency prices are constantly fluctuating, but at very small amounts, which means traders need to execute large trades to make money.

Currency futures are a trading instrument in which the underlying asset is a currency exchange rate, such as the euro to U.S. In the context of forex trading, a lot refers to a batch of currency the trader controls. Typical designations for lot size include standard lots, mini lots, and micro lots. It is important to note that the lot size directly impacts and indicates the amount of risk you’re taking. A pip stands for either “percentage in point” or “price interest point,” and represents the basic movement in a currency pair.

This is usually the only transaction cost you need to pay to your broker in order to open a Forex trade. Spreads can be as low as 1 pip on major pairs like EURUSD, but can widen in the event of lessliquid cross-pairs and exotic currencies. In order to start trading on Forex, all you need is a computer with internet access, a trading platform, and a brokerage account.

In the forex market, currencies trade in lots called micro, mini, and standard lots. A micro lot is 1,000 units of a given currency, a mini lot is 10,000, and a standard lot is 100,000. When connected, it is simple to identify a price movement of a currency pair through a specific time period https://day-trading.info/ and determine currency patterns. The aim of technical analysis is to interpret patterns seen in charts that will help you find the right time and price level to both enter and exit the market. This analysis is interested in the ‘why’ – why is a forex market reacting the way it does?

How to Trade Forex for Beginners: 3 Strategies to Learn How to Trade Forex

It is an order that closes your trade as soon as it has reached a certain level of profit. It is an order that you give to buy above the current price or an order to sell below the current price when you think the price will continue in the same direction. Our mission is to keep pace with global market demands and approach our clients’ investment goals with an open mind. Manned by 20 multilingual market professionals we present a diversified educational knowledge base to empower our customers with a competitive advantage. Don’t push aside the task of finding a reputable broker; it might as well be the make-it or break-it point of your trading journey. In the past, in order to obtain the desired currency, you will first have to convert your currency into U.S. dollars and then into the other currency you wish to obtain.

- Timothy has helped provide CEOs and CFOs with deep-dive analytics, providing beautiful stories behind the numbers, graphs, and financial models.

- We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

- Browse the articles below for an introduction to FX trading, including practical advice on how to become a forex trader and first-hand accounts from market practitioners.

- Now, even the average investors are capable of buying and selling currencies easily with a mere click of a button through their own trading accounts set up in various online brokerages.

The trader believes higher U.S. interest rates will increase demand for USD, and the AUD/USD exchange rate therefore will fall because it will require fewer, stronger USDs to buy an AUD. Note that you’ll often see the terms FX, forex, foreign exchange market, and currency market. These terms are synonymous and all refer to beginner’s guide to currency trading the forex market. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing. These are fast, responsive platforms that provide real-time market data.

For example, EUR/USD is a currency pair for trading the euro against the U.S. dollar. The broker basically resets the positions and provides either a credit or debit for the interest rate differential between the two currencies in the pairs being held. The trade carries on and the trader doesn’t need to deliver or settle the transaction. When the trade is closed the trader realizes a profit or loss based on the original transaction price and the price at which the trade was closed. The rollover credits or debits could either add to this gain or detract from it. This is obviously exchanging money on a larger scale than going to a bank to exchange $500 to take on a trip.

However, currency futures may be less liquid than the forwards markets, which are decentralized and exist within the interbank system throughout the world. In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves. In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange .